Business Model

Disciplined Investment & Management

• Acquire quality, right-priced and cash flowing assets with predictable cash flow streams via negotiated transactions to reduce basis, increase the probability of closing and to minimize “dry-hole” costs;

• Prioritize asset acquisitions that offer defined upside scenarios and payout potential. Our objective is not to simply acquire and collect assets. Instead, we specifically identify opportunities where upside payout opportunities can be recognized and subsequently realized;

• Selectively pursue the development of new assets that offer unique investment characteristics (typically as a result of short-fuse opportunities) and reduced timelines to realizing cash flow;

• Target assets that are regionally and operationally synergistic in order to streamline costs and to maximize efficiency while building regional expertise;

• Enhance (and potentially reposition) assets/businesses by capitalizing upon imbedded intrinsic and extrinsic upsides in order to achieve an uplift in annual EBITDA;

• Cohesively assemble all assets in synergistic and risk-diversified portfolios to create an integrated exit vehicle and to secure a corresponding premium upon liquidation.

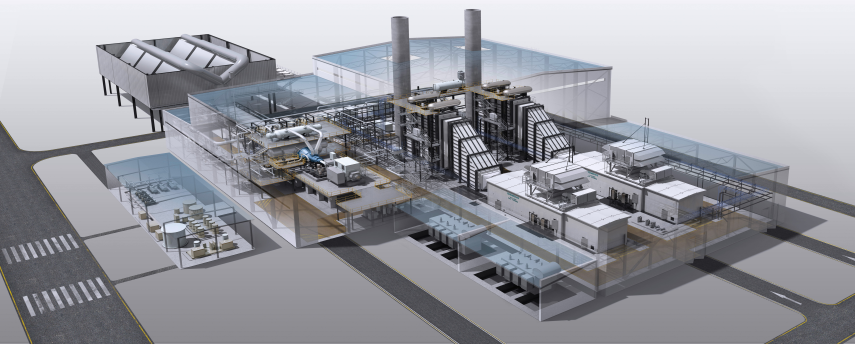

• Full range of independent asset management services for power projects